Generative AI is Having a MoviePass Moment

The current business trends around Generative AI risk repeating the mistakes of heavily-subsidized business models from the last decade

“Economics” can basically be boiled down to: if you offer me a trade to give me $5 in magic widgets in return for $1 in cash, then I will take that trade every time because I make an instant $4 profit. You might have reasons why you offered me that trade; maybe you expected I’d become dependent on your magic widgets and be willing to pay a higher price in the future. Maybe you actually didn’t have a strategy and were just trying to grow revenue without a thought to profitability. In either case, you could afford to do this today because you had someone else paying for that $4 loss on each trade. This all works out great for me, but not-so-great for you. You probably will eventually stop offering me trades like that.

This is also basically how MoviePass worked. They sold unlimited movie-watching tickets for a fixed price of about $10/month. You’d assume MoviePass was able to work out some kind of deal with theaters to offer this service. But nope, you’d be wrong. Instead, they paid the market rate for tickets every time one of their customers went to see a movie. Predictably, lots of people bought cheap MoviePass subscriptions and would do things like go watch “John Wick 2” 10 times in a month. MoviePass could afford this temporarily because they were backed by a lot of venture capital investment, which they garnered because they made big promises about growth and dubious ways they’d be able to monetize a massive subscriber base to generate profits. As might be expected, these profits never materialized, the bank account got drained, and they declared bankruptcy in 2019.

Thus, we got the namesake for “The MoviePass Economy” - an avalanche of partially-digital services that had the scaling engines and marketing strategies of SaaS companies; but had underlying unit economics and cost structures of delivery trucks, hourly laborers, and restaurants. The core products were expensive to deliver, but in a fixation on growth and with subsidization from venture capital, they were priced unprofitably and grown exponentially. This is like pouring rocket fuel on a small house fire because you think eventually you’ll be able to harness that flaming inferno to propel you to Mars. It started with Uber and to-cheap-to-sustain ride-sharing, then popped up in coworking office spaces, food delivery, furniture assembly, and others.

So of course founders, venture capitalists, and even consumers would have learned their lessons about leaning in too heavily on services that aren’t economic in the long-term, right? Right?! I think you know how this goes. Cue ‘the ChatGPT economy’.

ChatGPT wasn’t the first commercialized manifestation of Generative AI, but it is what made it mainstream. With its launch the world instantly got access to state-of-the-art Generative AI technology at cost of $0. This was the MoviePass moment. This made millions of people aware of what Generative AI could do, gave them easy access to it, and set a price-point in their minds for what the technology should cost: nothing.

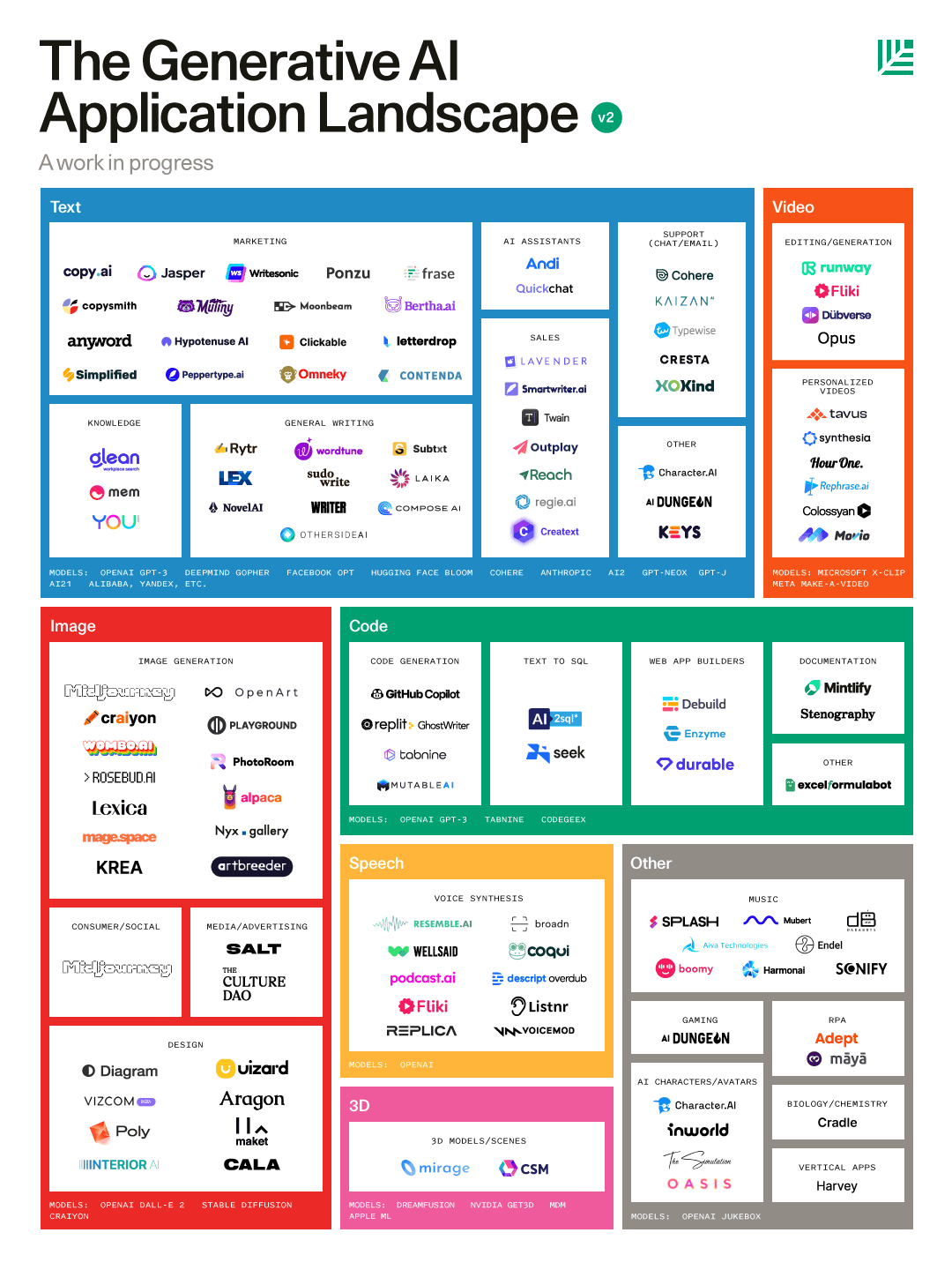

Now, there is a surge of new business models that revolve around offering inexpensive services to solve narrow and specific problems that harness the power of Generative AI. It’s a crowded space…

…and there’s a lot of money flowing into it. We’ve discussed this before: while overall VC funding is down ~50% since Q1 2022, VC investment in Generative AI is up 200%. That’s a lot of capital being poured into a startup battle royale for market share.

However, there's a glaring problem with the miracle of these seemingly affordable services—they are actually really costly to provide. Every time a one of these Generative AI services gets used, it activates a massive backend of networked GPUs that consume a lot of electricity. Each of these GPUs can cost into the tens-of-thousands of dollars and the electricity adds its own variable cost and environmental impact. By some estimates, a typical ChatGPT question costs 10X what a Google Search query cost. This is why Nvidia is a trillion dollar company. This is a cost structure that is rooted in energy markets, massive data centers, and computational infrastructure. Meanwhile, there is VC pressure to grow these companies like they are traditional SaaS businesses (with almost no marginal costs).

So, here we are. ChatGPT is out there and it’s free. Meanwhile, VCs are pouring billions of dollars into startups that have to convince people to pay good money for something they’ve been trained to think should cost nothing. Good luck!

There are a few shifts that could make this market more rational and avoid the MoviePass fate, but each of them is far from easy

Get customers to pay more. Prices are within the control of these companies, but only if they can convince consumers that the value is worth it. Given the reference price of $0 from ChatGPT, this will be a long and tough process. It has been done before - remember when there was no such thing as a paywall on a news site? But these transitions take years and industry-wide cooperation. It’s a prisoners dilemma.

Reduce the cost to compute. This would mean a dramatic change in the market dynamics for GPUs. This could happen as Nvidia continues to innovate, Moore’s Law holds true, and/or new entrants disrupt the GPU market. However, hardware innovations take years, if not decades, to play out. This time frame is probably far too long for many of today’s startups to benefit from them.

Reduce the required compute. Clever algorithms (or more clever use of algorithms) could deliver suitable quality of service with less comput required. ChatGPT employs some of these tricks by right-sizing the underlying GPT model to manage costs and speed. There are also frequent discoveries and innovations from the data science community on Generative AI algorithms are that are more efficient and less expensive to operate.

I think there two potential outcomes with any realistic chance of becoming reality:

MoviePass Redux: None of the shifts listed above happen and there is widespread failure of the current generation of Generative AI startups

Pricing improves and Algorithms get more efficient: Unit economics become positive as companies get more efficient with the algorithms they employ (stop using Ferraris when Camrys will do) and pricing becomes slightly more rational (gradually). There will still be many failed startups (as there always are), but some service providers will find this balance and succeed wildly.

Either way, don’t get too dependant to the AI chatbot writing your tinder messages - it’s either going to ghost you or order an expensive wine on your first date then not reach for the check.